It’s common knowledge that millennials have become the biggest and most influential market as home buyers and sellers. The real unanswered question for many is what does this mean for building business, relationships, and the thing driving both – the agent brand?

Millennials exhibit new technology behaviors that impact the home search and buying process. So not only do agents need to meet the Millennial market where they are, they also need to be prepared to build their brand and relationships with their millennial clients online, using new technology and social tools at their disposal. The challenge is understanding how to use these tools effectively.

The Millennial Affinity for Technology Cannot Be Ignored

According to the American Community and American Housing surveys, 66 million millennials in the U.S. currently represent 37% of the total national home buying market, making this generation the most significant home-buying demographic.

Digital processes are taking over the real estate market, especially within this population segment. The National Association of Realtors (NAR) cites that 99% of millennials search online to get general-purpose information about the housing market and home buying. Over half of millennials (59%) said they would be at least somewhat confident making an offer on a home they toured virtually. Additionally, 39% reported they would be comfortable buying a home online.

Why is this important? Quite simply, millennials approach homebuying differently than the baby boomer generation. Their preference for technology and a virtual experience redirects how they choose and interact with real estate agents. Knowing this, as an agent, begs the question: What can agents do to get the attention of the millennial market, keep it, and build their brand in a space where it will be seen?

Lead Generation Today Is Failing Agents (and their clients)

The lead generation methods of today are outdated. From finding leads, engaging in that initial fact-finding conversations, keeping those leads, and finally converting them, many agents rely on large lead generation companies such as Zillow and Redfin. These large lead generation companies offer buyers and sellers a standardized way to shop for every available house in the market. While technology has opened the gates for lead generation quantity, quality has suffered. The perceived value of agent service and differentiation has suffered as well. For instance, since clients don’t need to register as a buyer, agents can never be sure where they are in the buying process, what features of their home list appeal the most to them, and what they can live without. In addition, as these potential buyers enter their home search parameters, they are given a very general list of potential houses in the area and agent references. This results in increased lead numbers being sent out to local agents but lacking engagement and conversion. A typical conversion rate for Zillow and Redfin leads hovers around 4%.

Lead Generation Tomorrow

The key to staying relevant today and in the near future is through innovative technology and building a brand voice across social media platforms. As Millennials and even Generation Z age, their expectations for their home buying experience differ significantly from past generations. Their use of tech is reshaping the real estate industry, and staying relevant on the digital scene is mandatory. Unfortunately, these new technologies are underutilized by most agents simply due to a lack of awareness or understanding of how they can apply them to their fullest.

How can you use technology to ensure that millennials in your area work with you? Through:

Building know, like, and trust factors via social channels,

Creating a digital footprint in your local community, and

Personalized home search tools and targeting tools.

Social media can be daunting, and while many agents have profiles set up on various platforms, simply posting lead-gen ads with listing images isn’t going to cut it any longer. Think of social media as building your local network, or even your local community, on a digital platform. Your social profile should be an active area where you consistently post different forms of content to become a trusted authority in your local area and build on your know, like, and trust factor. How can you do this? Think of your social channels as a way to educate, inspire, inform and communicate with current and prospective clients. Your social platforms are also a way to build and hone your brand image, as often, this will be your market’s initial impression of your business.

Our top tips for building know, like and trust within the social space are below:

Pick 1, 2, or 3 platforms to focus on. Contrary to popular belief, agents don’t need to be on every platform. Concentrating on just a few platforms allows you to keep your posting consistent and meaningful.

Create a content plan and calendar to maintain a consistent posting schedule that creates value for your followers. You can create categories such as:

Current Listings and Just Sold Homes

Market reports in your local area

Restaurant reviews (tagging the restaurant to increase your reach)

Local Business Shout-outs (tagging the local business to increase your reach)

Local happenings or events

Blogs that you create

Informative posts such as:

What to expect as a first-time homebuyer

Top questions to ask your prospective agent

What does a buyer’s/seller’s market mean

Top tips to get your home ready to list

ROI on home renovations

The key is to post valuable content consistently while directing your followers to call, email, or contact you for questions or a consultation.

Become a trusted voice in your community, offering a fair opinion on local restaurants, events, businesses, new neighborhoods, services, etc.

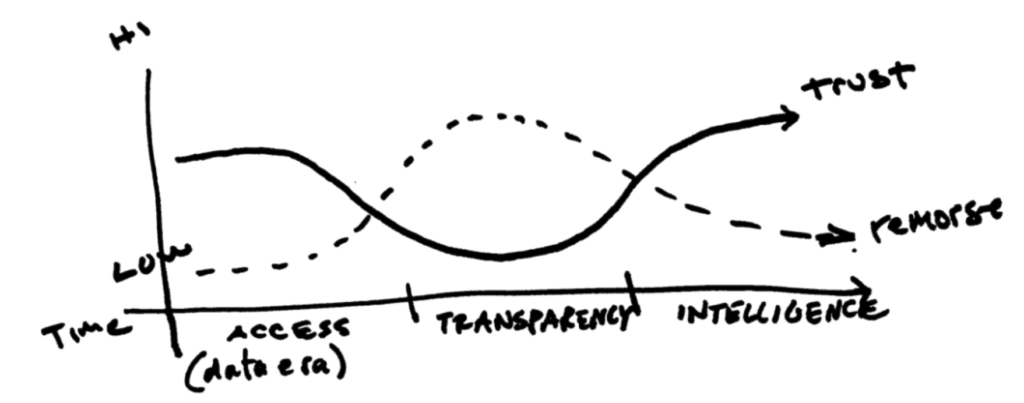

Real estate marketing has not caught up with opportunities created by AI technology, especially in home search and targeting. Innovative home search products will keep agents top of mind with the millennial market, personalize the home buying experience for buyers and sellers, and enable agents to create and develop a digital relationship with prospective clients. AI can track behaviors and prioritize their search by design, home features, and even room preferences in the local markets they are searching. Agents can personalize their communications using the tips mentioned above. Even more sophisticated automated intelligence can combine local search parameters with clients’ behaviors and interests for social media targeting that drives more effective ad campaigns.

Purlin is a pioneer in this area

These search and targeting tools elevate the client experience, enhancing know, like, and trust factors. They also spread the social footprint, as engaged clients share boards of their favorite homes, features, and rooms while shopping and recommend agents when a great home match is made.

The Return to Micro and Personal

Real estate is undergoing a massive transformation, and agents feel an urgency to be at the forefront of this change. The reality and irony is that the most effective use of new technology means returning to old-fashioned values of getting to know clients personally and building brands in local markets by leveraging existing local resources. Social media is simply a delivery mechanism. Applying a local social media approach will go a long way to satisfying the needs and expectations of the in-market Millennials. It also provides a direct connection from tech tools to the human touch that has been waning in the real estate industry.

So far in 2018, more new listings have been featured in California’s housing market than any year since 2008. If you’ll remember, that was the year of the financial crisis that rocked most industries, including real estate. In that year, there were only 10% more new listings for the same period compared to this huge jump in 2018.

So far in 2018, more new listings have been featured in California’s housing market than any year since 2008. If you’ll remember, that was the year of the financial crisis that rocked most industries, including real estate. In that year, there were only 10% more new listings for the same period compared to this huge jump in 2018. From January to September 2018, houses have spent an average of 19 days on the market. This is the lowest recorded number of days on the market since 2008, though it has been steadily declining since then.

From January to September 2018, houses have spent an average of 19 days on the market. This is the lowest recorded number of days on the market since 2008, though it has been steadily declining since then. In this seller’s market, having the ability to conduct a fast, zip-code-agnostic, real-time search aligned with your unique preferences and budget is critical. If you are forced to complete your search through typical web apps that require a mass of manual labor on your part, you simply won’t be able to act fast enough to secure a home.

In this seller’s market, having the ability to conduct a fast, zip-code-agnostic, real-time search aligned with your unique preferences and budget is critical. If you are forced to complete your search through typical web apps that require a mass of manual labor on your part, you simply won’t be able to act fast enough to secure a home.