change the question

About twenty years ago automated online home valuations became accessible to everyone. The immediacy of the insights quickly became an expectation bred into the process and the value proposition hasn’t changed since. Pick a home search site, enter an address, get a market value. A branded algorithm matches location-based pricing trends with square footage. Ta da, you have a ballpark estimate, invariably eliciting responses like, “how is our home worth so little?” or, “how is that house worth so much?” and, “what do we do now?”

The statistical vagaries of existing solutions drove us to discover a way to answer these questions by re-inventing the home valuation experience. It’s called StyleExplorer. It mashes up standard valuation (size and location) with intelligent image data of all of the attributes that should contribute a home’s actual value. The new value proposition is confidence, control and guidance in understanding the optimal valuation of home, whether you are selling, renovating or buying. The new approach changes the question from “how” the valuation was calculated, to “what does it mean” and “what can we do with it.”

do the new math

It’s a simple theorem: the sum of the rooms is bigger than whole (house).

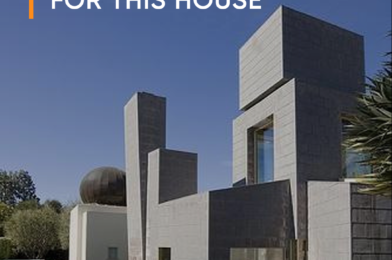

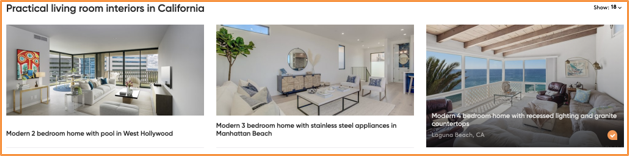

Purlin’s StyleExplorer image intelligence allows side-by-side comparison of homes’ individual assets like architectural style, rooms, backyards, and neighborhoods. For buyers it’s a unique experience analogous to crashing multiple open houses simultaneously. For sellers, when done across homes with similar market valuations, the comparison will reveal valuation gaps and opportunities. Some valuations will fall short of a home’s salient features (valuation to gain), some features will fail to look like they should (room to improve). These immediate insights are priceless to sellers and agents nurturing process. It’s truly the automated love child of the open house and the MVP (market value pricing analysis).

Imagine if you are ready for a remodel. You want to keep up with the latest designs and furnishings (and the Jones’s), or you just need some inspiration. Looking at catalogs is helpful but feels staged, if not inaccessible. What if you could look into rooms in the real world, that people live in, and see what your contemporaries have done with their homes? Imagine peeking into your neighbor’s living room, or backyard, or man cave. This tech was custom built for remodelers too.

make it a place to live, not a property to buy

Exploring what’s inside and around homes, the design touches in the photos owners have picked, taps into past or imagined experiences and makes a crude dollar value calculation for a property seem disconnected and even arbitrary. It humanizes home valuation by dimensionalizing it – it gets to what the value of a home really means in personal terms. With this unconscious shift from left brain to right the listing ceases to be a property to buy and becomes a future place to live. Traditional automated appraisal solutions ignore that with a purchase this big, and this important, beyond basic requirements the emotional value will most often prevail over rational appeals. Emotional value can compel buyers to favor one home over another, even with price disparity. Emotional response to image-based immersion, not clever language or negotiation techniques, powers buyer motivation.

take it to eleven

Without your permission, the world has a value in mind for your home. You have no control over whether it’s spot-on, a bit aggressive, or a total low-ball.

Purlin’s image intelligence gives back control, provides guidance, and perhaps most importantly endows confidence. It can illuminate misrepresentations and re-set home value conceptions, from a position of proof-based strength (pictures don’t lie, especially side-by-side). It arms users with evidence of weaknesses and strengths, what’s needed, what’s possible, and what’s truly meaningful. Sellers can feel smart and satisfied that they know clearly the value of what they are selling, glean what to showcase and how to prepare. Buyers can explore and understand (and love) the possibilities of what they can buy. Remodeler’s can learn how best to make their home better.

Our new vision for home valuation based on image intelligence forwards a fundamental belief about home valuations: they provide context not proof; the sum of the rooms, and future experiences in them, is often greater the unexamined appraisal. It allows you to take home value to eleven.

So far in 2018, more new listings have been featured in California’s housing market than any year since 2008. If you’ll remember, that was the year of the financial crisis that rocked most industries, including real estate. In that year, there were only 10% more new listings for the same period compared to this huge jump in 2018.

So far in 2018, more new listings have been featured in California’s housing market than any year since 2008. If you’ll remember, that was the year of the financial crisis that rocked most industries, including real estate. In that year, there were only 10% more new listings for the same period compared to this huge jump in 2018. From January to September 2018, houses have spent an average of 19 days on the market. This is the lowest recorded number of days on the market since 2008, though it has been steadily declining since then.

From January to September 2018, houses have spent an average of 19 days on the market. This is the lowest recorded number of days on the market since 2008, though it has been steadily declining since then. In this seller’s market, having the ability to conduct a fast, zip-code-agnostic, real-time search aligned with your unique preferences and budget is critical. If you are forced to complete your search through typical web apps that require a mass of manual labor on your part, you simply won’t be able to act fast enough to secure a home.

In this seller’s market, having the ability to conduct a fast, zip-code-agnostic, real-time search aligned with your unique preferences and budget is critical. If you are forced to complete your search through typical web apps that require a mass of manual labor on your part, you simply won’t be able to act fast enough to secure a home. There’s nothing like the excitement of deciding to buy your first home with your significant other. A new home comes with the promise of a fresh start, freedom to renovate as you’d like, and knowledge that you own something of real value—and that’s enough to make any young couple dive into the housing market.

There’s nothing like the excitement of deciding to buy your first home with your significant other. A new home comes with the promise of a fresh start, freedom to renovate as you’d like, and knowledge that you own something of real value—and that’s enough to make any young couple dive into the housing market. These are just a few of the common factors I see dual-income homebuyers prioritizing in their search for the perfect home. Each couple’s home buying process is unique, with individual couples balancing preferences ranging all the way from architectural style to closet size.

These are just a few of the common factors I see dual-income homebuyers prioritizing in their search for the perfect home. Each couple’s home buying process is unique, with individual couples balancing preferences ranging all the way from architectural style to closet size. An average listing contains about 180 words. If you review 20 homes for every one you visit, that’s a whopping 3,600 words you’ll review before you visit a house. If each listing contains about 28 photos, you will review 560 photos before you visit a house. That’s nearly an hour spent reviewing descriptions before you step inside a single home.

An average listing contains about 180 words. If you review 20 homes for every one you visit, that’s a whopping 3,600 words you’ll review before you visit a house. If each listing contains about 28 photos, you will review 560 photos before you visit a house. That’s nearly an hour spent reviewing descriptions before you step inside a single home.